2 STATE OPTION PRICING FILETYPE PDF

SP500 SPX options have a value of 100 so for an option contract with a strike price of 2800 one contract would be 2800 x 100 280000. The fixed price is.

Crossword Puzzle Bridal Shower Checklist Bridal Shower Games Wedding Games

T is a b22.

. The theory states that two otherwise identical assets cannot sell at di erent prices. There is a xed discount rate 201 per period due to the time value of money. As the call price is either 20 or 2 2 3 the difference is.

A short summary of this paper. Group with a shared identity that often seek to share a distinct territory and government Sovereignty. In period one the stock price is either 120 or 90 so the difference is S 120 90 30.

Unlimited viewing of the articlechapter PDF and any associated supplements and figures. Pearson Education Singapore Pte. 22 Valuing Options An option value is a function of time the current spot price of the underlying the strike price of the option the volatility of the underlying assets price and the risk-free rate of interest.

Th us in a BS world option prices w ould not b e an y more informativ e ab out preferences than b. Payoff of the call. Problems with traditional parametric option pricing.

Pearson Education Australia PTY Limited. The option contract under study may be written without an expiration date. The seller of an option has unlimited liability similar to the parties to a futures contract.

Printed in the United States of America ISBN. Generally most methods for valuing options can be categorized into two families of methods. Arrive at its price hence a 100 markup resulting in a 40 sales price to the consumer.

0 Full PDFs related to this paper. Cost-Based Pricing Using cost-based pricing Wow Wees accountants would figure out how much it costs to make Robosapien and then set a price by adding a profit to the cost. Verizon Wireless Pricing and Equipment Offer.

EXPIRATION DATE Options have a limited life span and expire on a certain date. If state 2 occurs the portfolio is worth s 2 2 c 2 90 2 0 90. Articlechapter can be printed.

3 Arbitrage One of the most fundamental theories to the world of nance is the arbitrage pricing theory. In this figure S is the current stock price. Articlechapter can not be redistributed.

The price of the asset may not follow a continuous process which makes it difficult to apply option pricing models like the Black Scholes that use this assumption. The presentation reviews the current state of non-parametric option pricing covering. The expiration date is the day on which all unexercised options expire and can no longer be traded.

Price and the underlying asset price. In section 2 we review the mathematical back-i 5. As a result the option seller is usually required to post margin as in a futures contract.

Financial Economics Two-State Option Pricing Risk-Free Portfolio If state 1 occurs the portfolio is worth s 1 2 c 1 120 2 15 90. The stock price process follows a discrete time and discrete state random walk. 69 the owner of the option will not exercise the option and it will expire worthless.

The portfolio is indeed risk-free. PDF download and online access 4900. We extend realized volatility option pricing models by adding a jump component which provides a rapidly moving volatility factor and improves on the fitting properties under the physical measure.

The general formulation of a stock price process that follows the bino-mial path is shown in Figure 53. The variance may not be known and may change over the life of the option which can. Both Assistant Professors of Finance Graduate School of Management Northwestern UniversitySearch for more papers by this author.

Parametric and non-parametric adjustments to Black-Sholes model and purely non-parametric methods. INTRODUCTION TO OPTIONS An option is a contract written by a seller that conveys to the buyer the right but not the obligation to buy in the case of a call option or to sell in the case of a put option a particular asset at a particular price Strike price Exercise price in futureIn return for granting the option the seller collects. C Leonid Kogan MIT Sloan Stochastic Calculus 15450 Fall 2010 14 74 Stochastic Integral Itôs Lemma Black-Scholes Model Multivariate Itô Processes SDEs SDEs and PDEs Risk-Neutral Probability Risk-Neutral Pricing.

The Bible of Options Strategies I found myself cursing just how flexible they can be. 10 in state A and 0 in state B option price between 0 and 10 suppose state A comes with probability p state B with probability 1-p a natural argument will give option price 10p arbitrage portfolios can be constructed unless p12. An employee of Customer utilizing Wireless Service whose account is set up in State of Delaware Customers name and for which Customer bears payment responsibility.

Characteristics of the modern state Territory. 0-13-171066-4 Pearson Education LTD. The binomial option pricing model is based on a simple formulation for the asset price process in which the asset in any time period can move to one of two possi-ble prices.

It is a pricing model for options in which the assets underlying the instrument is allowed only two possible values discrete in nature in the next period of time for. An area with clearly defined borders to which a state lays claim Nation. Ie th e option pricing form ula is preference free.

Quality of a state in which it is legally recognized by the family of states as the sole legitimate. The contracts standardized features allow fu- tures and options to be traded quickly and effi-. State of Delaware Contract No.

In this case the buyer would lose the purchase price of the option. Financial Economics Two-State Model of Option Pricing Call Price in Period Zero Working backwards we work out in the same way the call price in period zero when the stock price is 100. Up to 10 cash back Stochastic and time-varying volatility models typically fail to correctly price out-of-the-money put options at short maturity.

KEYWORDS Black-Sholes model Neural Networks Classification and Regression Trees Genetic Programs 1. Articlechapter can be downloaded. Introduction An option is a security that gives its owner the right to trade in a fixed number of shares of a specified common stock at a fixed price at any time on or before a given date.

Two-State Option Pricing Model Also known as the binomial option pricing model. The act of making this transaction is referred to as exercising the option. Mark-up allows the retailer to cover its costs and make a profit.

Can lose at most the premium or price paid for the option. The rest of this paper is organized as follows. Download Full PDF Package.

Tennessee With Tri Star Svg Bundle Tri Star Star Svg Tennessee

Water Slide Birthday Invitation Water Slide Invite Pool Etsy Water Birthday Parties Water Birthday Joint Birthday Parties

Soap Labels Simply Natural Editable Soap Template Etsy In 2022 Soap Labels Soap Labels Template Diy Soap Labels

Pin On Svg Files Bundles For Cricut Silhouette

Baby Shower Game Baby Around The World Shower Game Adventures Await Shower Game Baby Around The World Digital Download Travel Theme In 2022 Travel Baby Showers Travel

Tractor Birthday Invitation Tractor Party Digital Printable Etsy Tractor Birthday Party Tractor Birthday Invitations Tractor Birthday

Ohio Buffalo Plaid Svg Png Etsy Ohio State Crafts Ohio State Wallpaper Svg

Marblesystems 1 85 X 2 Marble Mosaic Tile Marble Mosaic Calacatta Marble Mosaic Tiles

Pin On Nicos Surprise Birthday

Dna Structure Replication Pear Deck Presentation Distance Learning Pear Deck Distance Learning Science Lessons Elementary

Tractor Birthday Invitation Tractor Invite Farmer Etsy Tractor Birthday Invitations Tractor Birthday Party Tractor Birthday

5x7 Spa Party Birthday Party Invitation Zazzle Com Birthday Party Invitations Party Invitations Kids Spa Birthday Parties

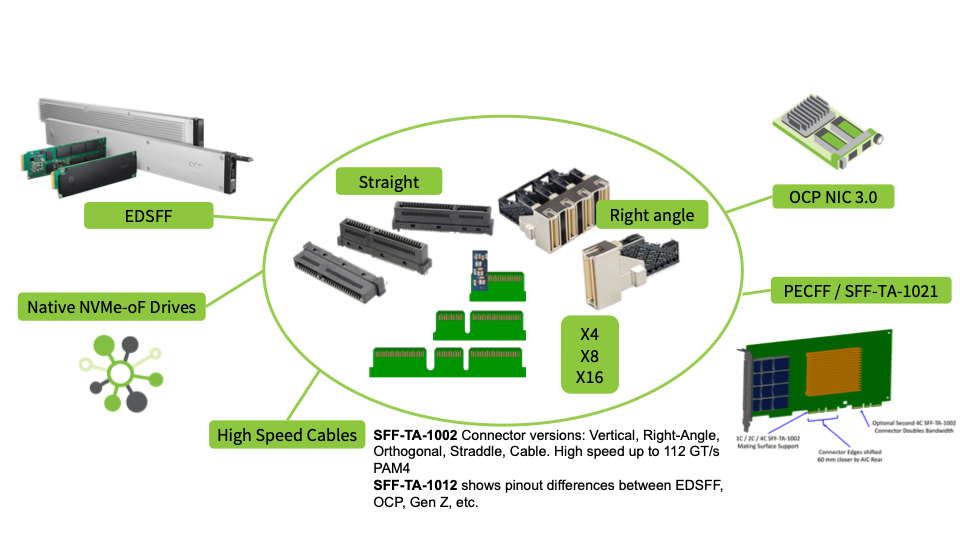

Solid State Drive Form Factors Snia

Go Maize Go Blue Michigan Wolverines Football Football Svg Football Gift Michigan Football Football Lover Football L Go Blue Cricut Vinyl Michigan Decal

0 Response to "2 STATE OPTION PRICING FILETYPE PDF"

Post a Comment